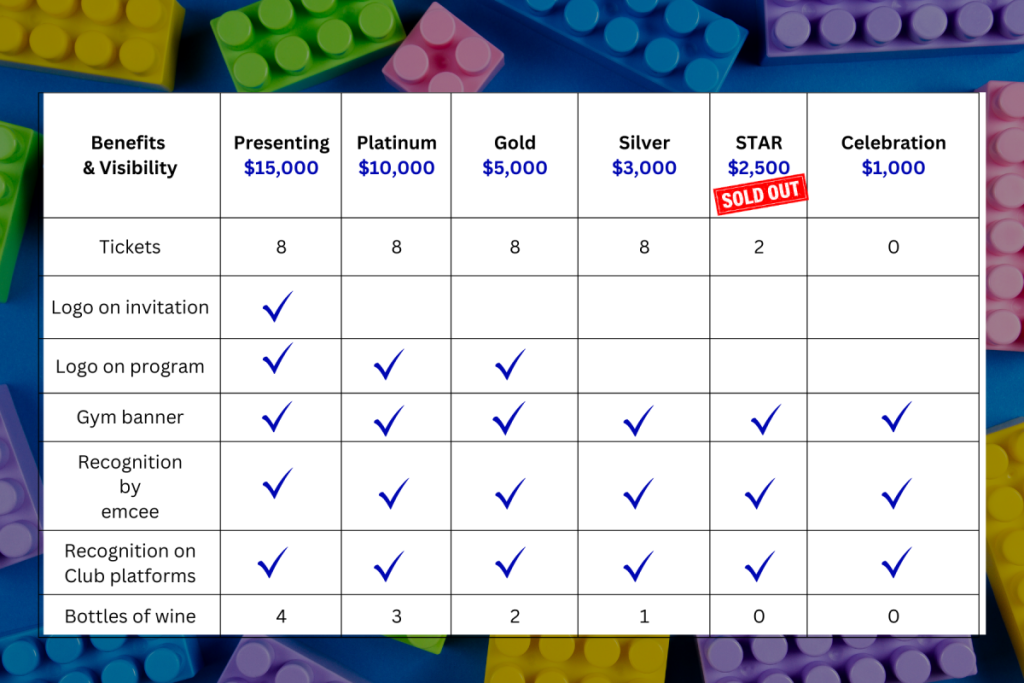

Important Notice Regarding Contributions from Donor-Advised Funds and Private Foundations: In accordance with IRS regulations, we are unable to accept payments from donor-advised funds (DAFs) or private foundations for any portion of contributions that result in a personal benefit to the donor. This includes, but is not limited to:

Event tickets

Sponsorships that include goods or services (e.g., meals, advertising)

Auction items

Raffle entries Contributions from DAFs or foundations may only be used for fully tax-deductible donations where no goods or services are received in return.

Please consult your tax advisor to determine the eligibility of your contribution. We appreciate your support and understanding.